“Business Owners Looking to Retire May Be Surprised by How Little Their Business is Worth”

The BizExchange Index

A report on Australian Private Business Values

A report on Australian private business values reveals the sale price of your small business is likely to reduce due to a “new wave” of retiring business owners.

Shocked? As a growth leader, chances are, you are not.

Recently Business Growth leaders published an article on preparing your business for sale, its importance in a saturated market, and the two types business buyer. Our business experience and research told us that without solid, consistent financials and a business that runs without you… you have a slim chance of finding a buyer or getting the price you want. You can read the article here:

The BizExchange report confirms our beliefs about the marketplace.

The report found an emerging trend of Baby Boomers looking to sell their business. Describing it as a “flood”, the report points out the increase in business listings is a major factor in the falling value of businesses. From other research we know that around 60% of Australian businesses are owned by Baby Boomers so any trends in this age group will impact the whole of the market.

Looking forward however, researchers say there is no guarantee this trend will continue; that whilst baby boomers are hitting retirement age, they may look at falling business values and decide to stay in business. But either way this doesn’t paint a pretty picture for small business owners.

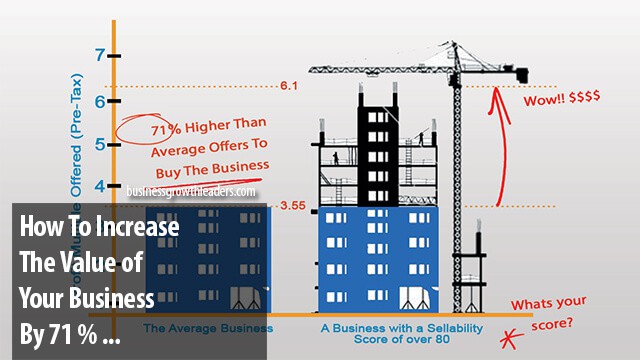

On the one hand, you can sell your business and risk a lower price (if your business is not a consistent performer that runs without you). For example, The BizExchange tells us there are businesses selling for less than a year’s earnings!!

And on the other hand, you can stick it out; chew into your retirement plans and muster the energy for the next 5-10 years of business. Are you ready and willing to do that?

Here’s how BGL interpreted the report:

- The oversupply in business listings between March 2007 and September 2008 reduced business values by half

- Prices stable in 2009 and 2010. Fluctuations due to varying degree in the quality of businesses for sale (i.e. businesses without strong balance sheets earned a lower price)

- BizExchange predict a “new wave” of businesses will hit the market as baby boomer’s prepare for retirement

- The price of micro businesses will subsequently be “dragged down”

- Higher volume of private business sales (evident in lower sale prices.)

- Increase in businesses selling for less than a year’s earnings

- Small business look to owner operators as a potential buyer

- Gen x gen y unable buy businesses due to high levels of debt, high house prices, and an inability to access superannuation savings

- Spoilt for choice, business buyers expect tight due diligence and strong balance sheets